Many valued customers were welcomed to our fifth and final Aviagen® Turkeys (ATL) Technical Talk for the 2021 series, which was held on Tuesday 9th November 2021. Technical Talks are a great way for us to stay in touch with our customers throughout these unprecedented times and allows us to continue providing top quality service during the COVID-19 pandemic.

Technical Talk topics presented were 'An update on the turkey market and outlook for 2022' by Clay Burrows Managing Director of ATL, 'Development of the North African and Middle East turkey Market' by Jean-Luc Favennec Regional Director of Aviagen Turkeys France and 'Avian influenza and the impact on trade’ by Dr. Wiebke Oellrich Company Veterinarian of ATL.

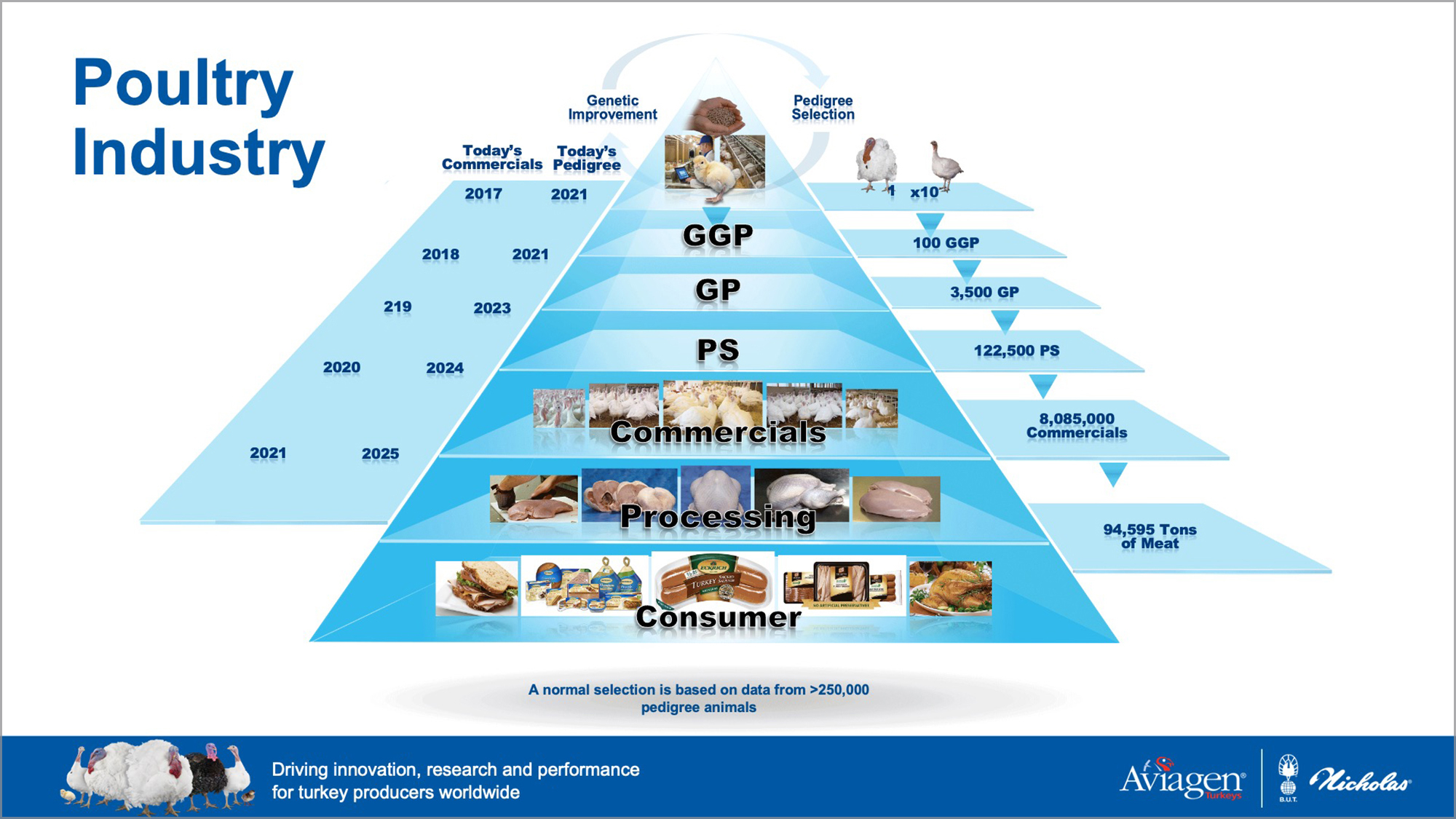

Clay began his presentation by outlining the structure of the company; the many diverse pillars which form the EW group, and how many pillars are expanding and moving forward. The EW Group is involved in many business activities such as breeding and vaccines and is 100% family owned. Clay added ‘Looking at the poultry breeding pyramid, we operate at a pedigree, great grandparent, grandparent level selling parent stock. It is vital what we select for, is correct, 1 pedigree male mated with 10 pedigree females is responsible for over 90,000 tons of turkey meat. The commercial birds used today were selected at a pedigree level 4 years ago and what we are selecting today you will not see commercially until 2025”.

Clay went on to discuss the company’s strategy to go further into distribution to be closer to customers and the industry. This now includes Select Genetics, Le Sayec and Aviagen Turkeys Russia. Covid-19 made many situations for the industry difficult as Clay explained “Food service/ manufacturing had a massive reduction, causing an oversupply of meat, along with a drop in live bird prices, whilst feed prices were increasing to all-time highs”.

Clay then spent some time looking at the turkey poult placement numbers for the last 5/6 years for countries such as UK, France, Italy, Germany, Poland, Hungary, Spain, Russia and the US. He then moved on to look at the first 6 months of 2021 which overall still sees a decline compared to the year before. Looking at the rest of 2021 and into 2022, Clay highlighted the continuing threats of Avian Influenza, the effect of Brexit on Christmas placements along and uncertainties Covid-19 still brings.

On a brighter note Clay discussed the US and how companies such as Subway are now back on track and increasing breast meat prices ($+3.20/lb Sept 21). Some normality is returning in the hospitality and tourism sectors, but it is unclear if it will return to pre-pandemic levels. Clay finished with inflation having a serious dent financially in all sectors and questioned if it be here to stay?

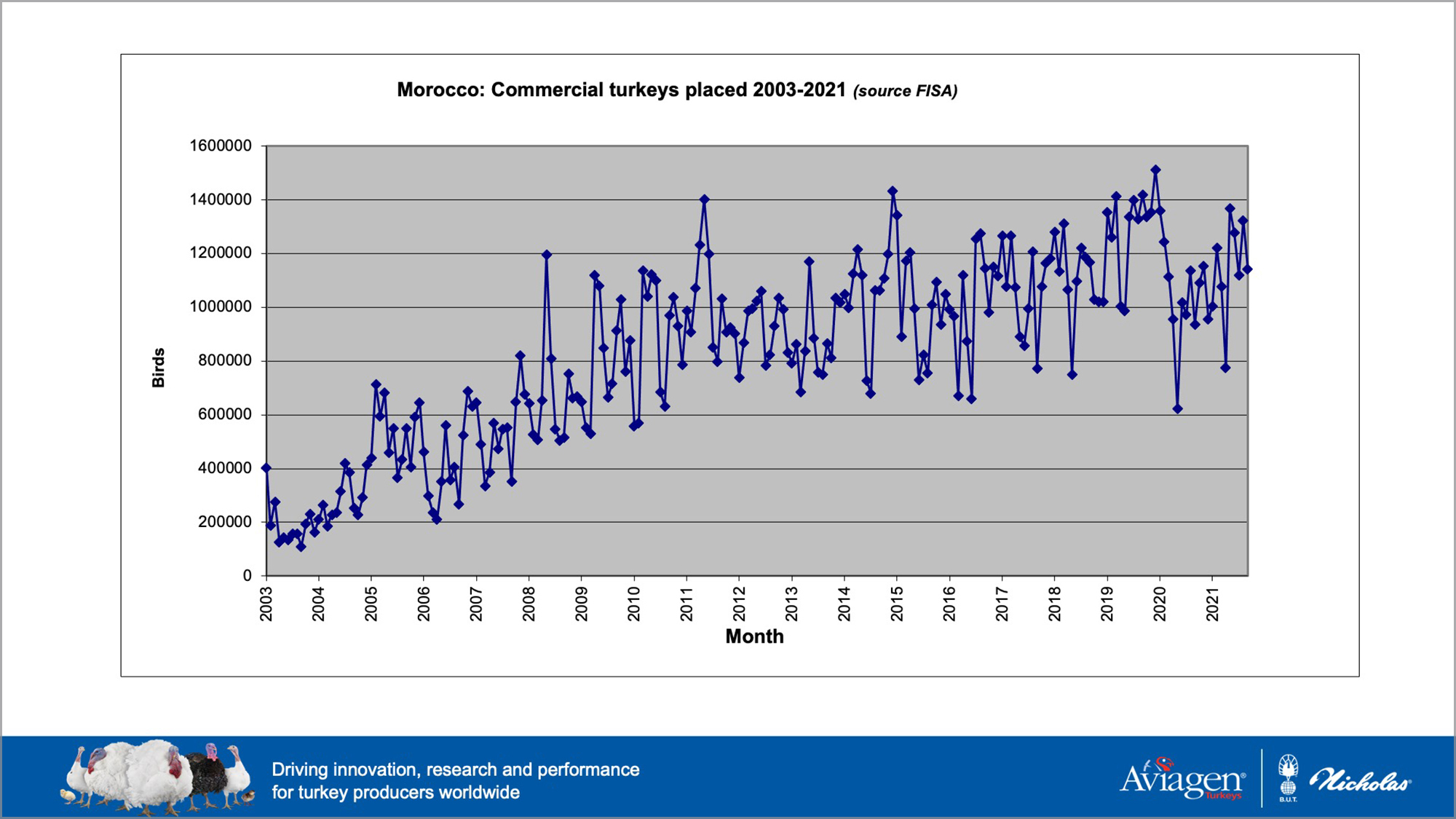

Jean-Luc started his presentation by discussing the opportunities in two continents where turkey consumption has been growing in the last two decades. These were North Africa and Central Asia. Jean-Luc started with North Africa and explained the younger generations are changing taste and habits whilst looking for easy products to consume. However the demand for white meat and dark meat is still well balanced. This lead to examples of Tunisia, Morocco, Algeria, Egypt and the Sub-Saharan areas of Africa, which showed the differences in their housing of turkeys, poult placements, along with other facts regarding the turkey market.

Jean-Luc then explained the examples of Middle East and Asia, such as Israel, Republic of Turkey and Iran, sharing the issues and points of interest for the turkey market in these countries. Jean-Luc finished on explaining how the turkey market is so versatile due to festivals, seasons and that will not change. Animal health is also an issue along with labour as getting the correct type of training can be difficult. However these countries continue to show enthusiasm towards turkey meat and other countries are looking to start producing one day.

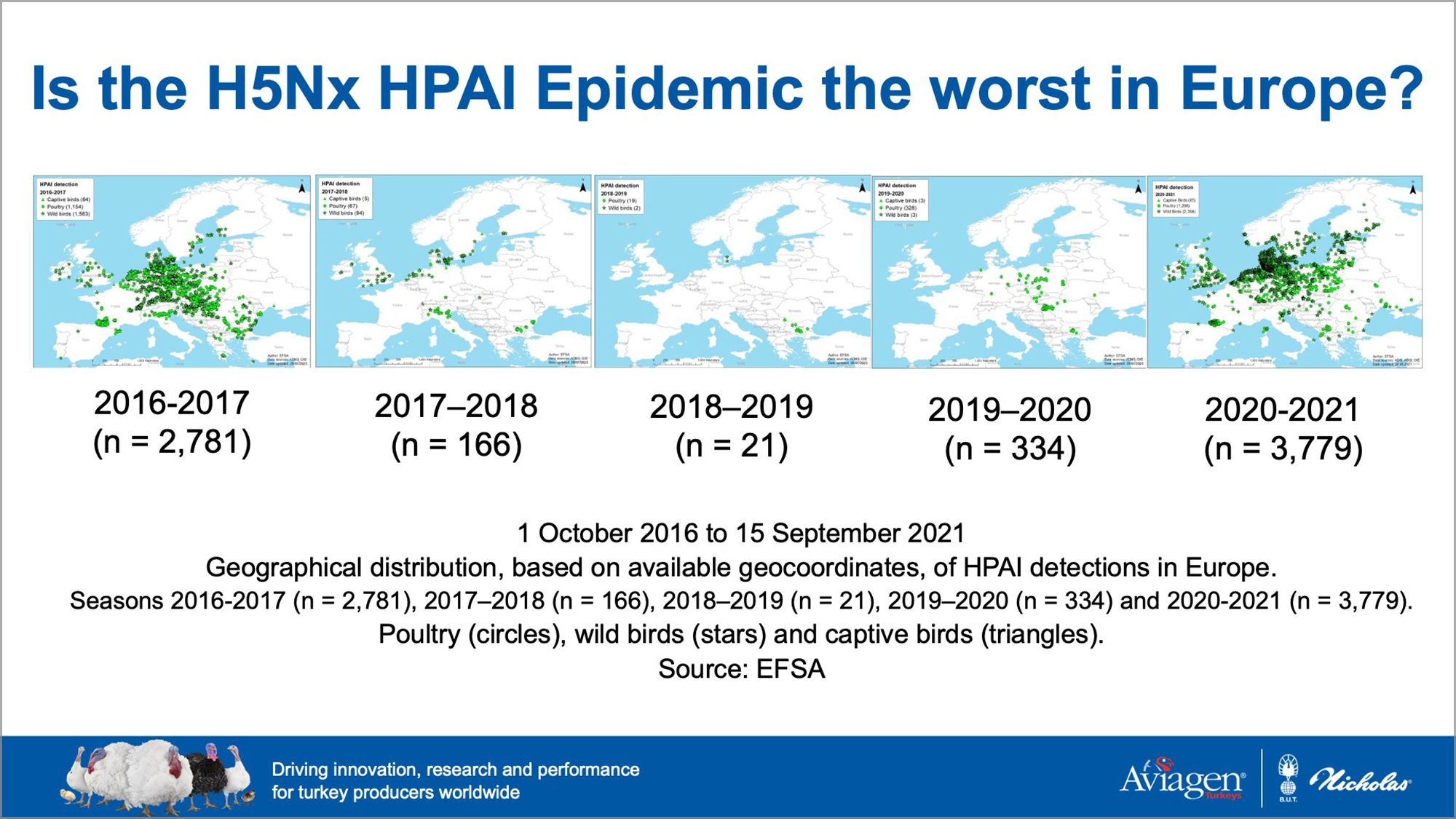

To finish, Dr. Wiebke Oellrich gave a presentation on avian influenza and the impact on trade. “The 2020-2021 avian influenza epidemic is the largest HPAI epidemic that has ever occurred in Europe with a total of 3,777 reported HPAI detections and approximately 22.9 million affected poultry birds across 31 European countries”.

Describing the last 5 season’s shows how cases have increased even since 2016/2017. This now includes outbreaks lasting longer, producing a longer risk window. Wiebke then discusses the trade continuation and depending on the market and location other factors can provide challenges.

Going through these different challenges, Wiebke firstly discusses third country rules such as Export Health Certificates and how they differ in each country and what to look out for. She also covered Regionalisation – Compartmentalisation, changes in OIE Terrestrial Animal Health Code on AI, such as definition of poultry, change of flock level incubation period and more.

Further detail then went into vaccination, “The way things are progressing in Eurasia, new ways to deal with the situation have to be found.” Wiebke explained the different variations and how options have changed over the years, which now means it is time to re-evaluate the use of vaccines as a tool to manage the situation the industry faces.

With wild birds being natural hosts and reservoirs for all types of AI viruses, they play a major role in the evolution, maintenance and spread of these viruses. Therefore high biosecurity is key in management and needs continued improvement. Wiebke ended the presentation summarising how AI will continue to be a major threat to the poultry industry and the changes we need to see in the field, along with high biosecurity, better communication between governments and faster action of OIE.

From everyone here at ATL, we would like to say a huge thank you to all of our customers who took the time to attend all of the Technical Talks during 2021.